POPPING THE BALLOON: WHY LEAVING THE UK MIGHT NOT QUITE BE THE ‘CLEAN BREAK’ FROM UK TAX

POPPING THE BALLOON: WHY LEAVING THE UK MIGHT NOT QUITE BE THE ‘CLEAN BREAK’ FROM UK TAX

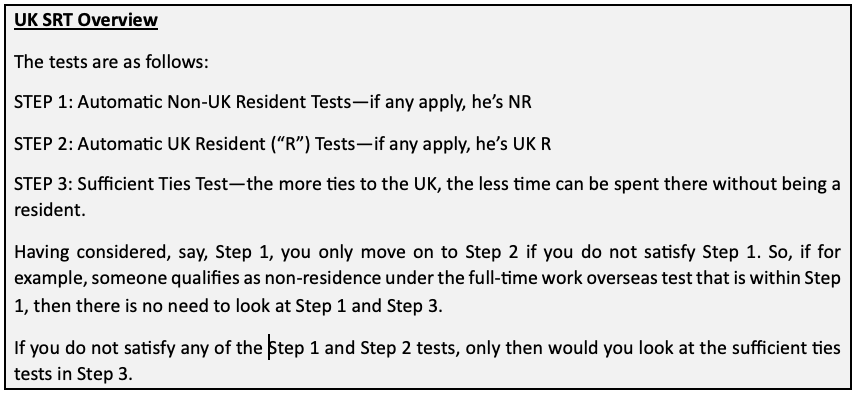

Generally speaking, one is either R or NR for the entire tax year (oddly, 6 April 20X4 to 5 April 20X5 in the UK).

However, one can qualify for split year treatment in certain scenarios meaning one can slice and dice the tax year into resident and non-resident periods.

A detailed consideration of the UK residence rules is beyond this article. But, certainly, as someone leaving the UK, I cannot stress how important it is to get advice in this area. It will be money well spent.

Scope of UK taxes for non-resident

So, where’s my balloon popping pin?

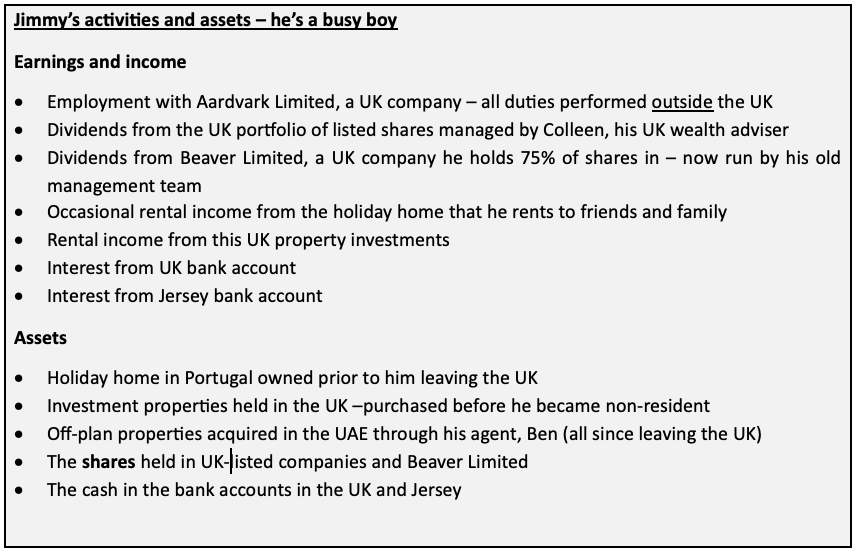

Let’s assume there’s no doubt that our client, Jimmy, is properly NR (he’s also UK domiciled for the short time remaining that this is relevant). Even HMRC agrees. He left the UK to move to the UAE with his family three years ago.

Jimmy, as they say, has his fingers in many financial pies.

So, let’s look at his UK tax exposure.

Income

The basic principle is that UK residents pay UK income tax on worldwide income and NR’s pay UK income tax on UK source income. Obviously, our man Jimmy’s the latter.

But this is UK tax. So, there are exceptions. And exceptions to those exceptions!

Firstly, some UK income is specifically disregarded from UK tax in the hands of an NR. For example, dividends from UK companies is such income.

But not all dividends are the same. The dividends from Beaver Ltd, his private company, will be subject to an anti-avoidance rule. The rule is complex, and best explained by describing the mischief it targets.

Let us say Jimmy was reasonably smart. He realised that UK dividends paid whilst he was NR are outside of UK income tax as disregarded income. So, a few years before he left he simply allowed surplus profits to roll up in his company, knowing he could decant those funds tax-free whilst NR. Cunning, eh?

However, the anti-avoidance rule will say, that any of those rolled up profits that arose whilst he was UK resident are subject to a 5 year tail. If Jimmy takes them as a dividend then there is no immediate tax. But if his stay outside the UK is not more than 5 complete tax years then the dividend will become taxable on return. Note this does not apply to any profits of the Company that arose whilst Jimmy was non-UK resident.

This rule would not apply to the portfolio of listed shares.

Despite the role he has with Aardvark being with a UK company, being NR, with the duties being performed outside of the UK, this is not taxable in the UK and the employer should not operate PAYE.

The rental income from his UK properties will be taxable in the UK and he’ll be categorised as a Non-Resident Landlord. This imposes and obligation on a tenant or an agent to deduct and pay over to HMRC a withholding tax on rents received. The good news is one can apply for the NRL scheme, which allows one to receive rents gross. Assuming the individual has kept their nose clean with HMRC previously, then this is largely a formality.

However, the landlord still needs to pay tax through their self-assessment on the normal basis.

The rental income from Portugal will not be taxable in the UK.

The interest from the UK bank account will be taxable whereas the interest from the Jersey bank will not.

As a UAE tax resident, this income is outside the scope of UK corporate income tax (which counter-intuitively, can apply to natural persons) and there is no local personal tax.

Capital gains

UK CGT is a relatively simple tax. The general rule is that one pays UK CGT if UK resident. If not, then you don’t – even if assets are in the UK.

However, the jurisdictional scope has been extended to include UK real estate – regardless of whether residential / commercial or held directly / indirectly.

As such, if Jimmy sells any of his UK properties – regardless of whether he purchased them pre / post breaking his UK residence – then they are subject to UK CGT. He will need to report the disposals within 60 days – rather than simply waiting for the usual self-assessment deadline to come around.

If Jimmy sold his non-UK property then the position is a nuanced one. The basic rule is that this sale would be outside the scope of UK CGT. However, because he owned this property when he left the UK, there is a 5 year anti-avoidance tail. This means that if he sells the property there would be no immediate UK CGT. However, if he returns to the UK without being out of the UK in excess of 5 years, the gain crystallises on his return.

The same 5 year rule would apply to his holding in Beaver Limited.

As the UAE properties were acquired after he left the UK, there’s no UK CGT on a sale whilst NR.

Again, no local taxes would apply to these sales.

IHT

Under rules that will remain in place only until up to 5 April 2025, UK IHT was almost entirely based on a person’s domicile.

Broadly speaking, non-doms would only pay IHT on UK assets and not on their foreign ones unless they became deemed domiciled (usually after being resident in the UK for 15 years).

For UK domiciled individuals (regardless of residence status), and those who have become deemed domiciled, their worldwide assets are subject to UK IHT.

This was not good for expats as domicile is based not just on physical presence outside the UK but also on their intention to remain permanently or indefinitely in that same place. This meant that, as well as being uncertain, it was also precarious.

From 6 April 2025, there will also be a new residence-based system. Domicile is out. A person will be subject to UK IHT if they have been UK resident for 10 / 20 tax years.

As such, long-term expats will have greater clarity by applying the 10 year test.

So, going back to Jimmy, at the moment, ignoring any reliefs that he might qualify for, he will still be subject to UK IHT on all of his assets as he has only been NR for three years.

However, fast forward a few years such that he has been NR for more than 10 tax years, he’ll only be subject to UK IHT on UK assets (the UK properties, the shares in Beaver Limited (subject to business property relief) and his UK bank account).

Conclusion

The above hopefully illustrates that one does not escape UK taxes simply because one has upped sticks, and unpacked one’s life overseas. The UK tax system has a long reach and never assume you’re ‘out of sight, and out of mind’ when it comes to HMRC.

If in doubt, ensure you get some proper advice. Click here to contact on of our trusted advisors.

With that, I will put away my balloon-popping pin away.

Are you living in Dubai and want to know what the new Spring Statement/UK Mini Budget means for your financial future, then join us on 24th April 2025 at the Avani Palm Hotel, for an evening of expert analysis, practical advice, and strategic networking to help you understand what the latest updates mean. Our Founder Andy Wood will discuss tax policies already outlined in this area – including in relation to income and gains and, importantly IHT for Non-UK long-term residents – and any new nuggets unveiled by Mrs Reeves.