UK Non-Dom Tax Rules: The End is Nigh, But What Next?

UK Non-Dom Tax Rules: The End is Nigh, But What Next?

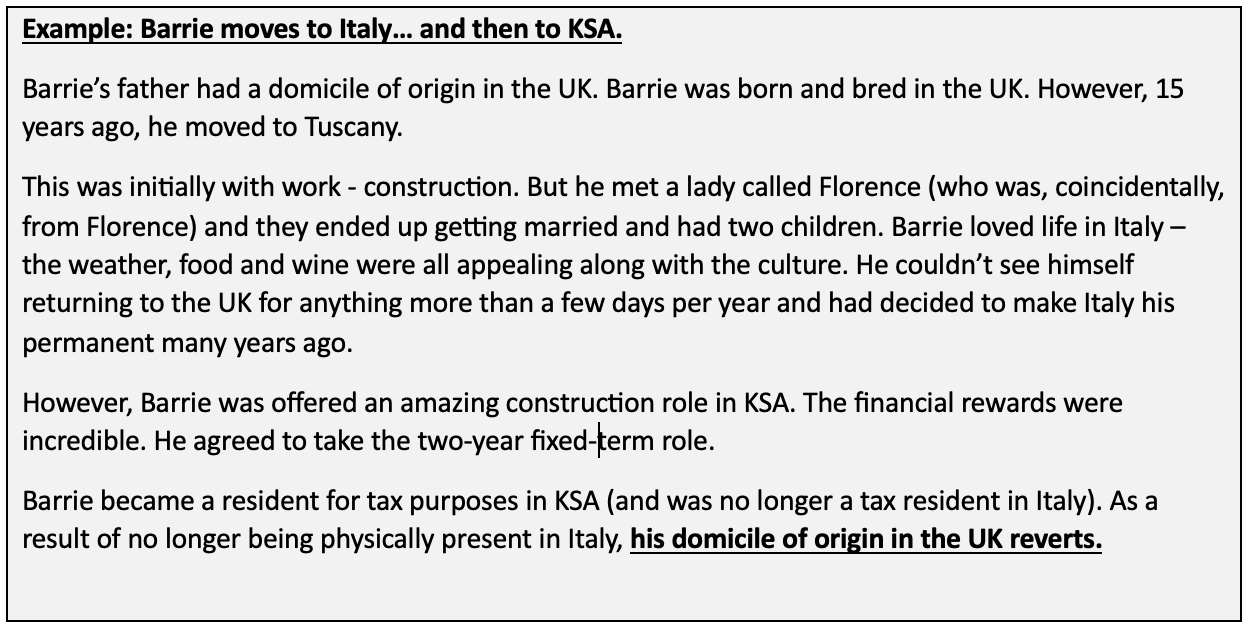

As you can see, the domicile of origin is ready to rise back from the dead as soon as either ‘intention’ or physical presence changes.

On the other side of the coin, those with domiciles of origin outside the UK who have moved to UK have been able to reject a UK domicile of choice as long as they have not formed the intention to stay in the UK.

As I say, domicile of origin is a sticky thing. Difficult to shake and always ready to return.

The UK’s Non-Dom Rules (Before 6 April 2025)

“So what?” I hear you say.

Income tax & CGT

Well, under the current system, non-doms can elect to be taxed on something called the remittance basis for (broadly) up to 15 years of UK residence. This means:

· Foreign income and gains are only taxed if brought into the UK (remitted).

· A £30,000–£60,000 annual charge applies after 7 years of residence.

· After being resident for 15 /20 tax years, non-doms become deemed domiciled and their remittance basis rights are revoked.

Inheritance Tax (IHT):

· Broadly speaking, non-doms only pay IHT on UK assets.

· Foreign assets remain outside the scope unless they become deemed domiciled after 15 /20 tax years.

· For UK domiciled individuals, and those who have become deemed domiciled, then their worldwide assets are subject to UK IHT. Those non-doms approaching deemed domiciled could often use ‘excluded property trusts’ to park assets outside the scope of UK into the future.

These rules have been criticised for benefiting the ultra-rich. Regardless, they have also, undoubtedly, made the UK an attractive hub for international wealth, talent and investment.

So, what do the changes look like from April?

The New Rules from 6 April 2025

Out with the old

As I’ve already alluded too, the remittance basis will be abolished and, more broadly, the link between domicile status and tax will be (almost) entirely removed.

There are some transitional rules for those former remittance basis users.

In with the new: Income Tax & CGT

From 6 April 2025, we will have a new and shiny regime called the Foreign Income and Gains (FIG) Exemption which includes:

· A 100% exemption for foreign income and gains for the first 4 years of UK residence for new arrivers in the UK (as long as have not been resident in the UK in any of the previous 10 years)

· After 4 years, all worldwide income and gains will be fully taxable in the UK.

In with the new: IHT: The End of the Domicile Link

There will also be a new residence-based system for IHT purposes:

· Non-doms will now become subject to UK IHT on their worldwide assets if they have been UK resident for 10 out of 20 years.

· This replaces the old 15-year deemed domicile rule with a 10-year exposure period, but crucially, non-doms leaving the UK will remain within the IHT net for up to 10 years after departure—making long-term estate planning far trickier.

Once caught, IHT applies at 40% on worldwide assets. Controversially, this will include pre-existing offshore trusts and other structures (beyond the scope of this article but anyone effected should review as soon as possible).

An Unexpected Fairytale for Expats?

Long-Term Expats and IHT

For long-term expats, there new rules provide much more certainty around their IHT exposure. Previously, they would have had to be confident they were non-domiciled in order for their non-UK assets to escape the IHT net. Even then, any planning was dependent on not disturbing their domicile of choice – a precarious status (see the example of Barrie above).

However, someone who has not been resident in the UK for 10 out of the last 20 tax years will benefit from non-Uk assets in their death estate being outside the scope of IHT and will be able to make outright gifts of non-UK assets which are disregarded for UK IHT purposes.

It is worth noting that, unless some relief or exemption applies, then any person with UK assets will be in the scope of UK IHT. Even if they have never set foot there!

Returning Expats and the FIG Regime

The FIG regime also offers a clear plan window for returning long-term expats. If they have been non-UK resident for 10 years, the FIG regime will apply for the first 4 tax years.

Conclusion

The UK will shortly wave a tearful farewell to the remittance basis of taxation. Whether the new FIG regime will be attractive enough to tempt international mobile wealth remains to be seen.

However, as we have seen, the new rules do provide some un-expected benefits for long-term expats in the form of certainty when it comes to estate planning and an attractive benefit for those returning to the UK.

With that, I can hear the bell tolling.

At Mosaic Chambers Group, we help private clients make sense of these changes and create strategies that protect their wealth across borders.

Are you living in Dubai and want to know what the new Spring Statement means for your financial future, then join us on 24th April 2025 at the Avani Palm Hotel Dubai, for an evening of expert analysis, practical advice, and strategic networking. Our Founder Andy Wood will discuss tax policies already outlined in this area – in relation to income and gains and, importantly IHT for Non-UK long-term residents – and any new nuggets unveiled by Mrs Reeves.