“Every dog has its day… or century or two”: The end of the remittance basis of taxation etc PART ONE

Andy Wood • February 18, 2025

This is the first in 3-part series on "The End of the Remittance Basis of Taxation"

Background – The British Bulldog v French Bulldog

PART 2

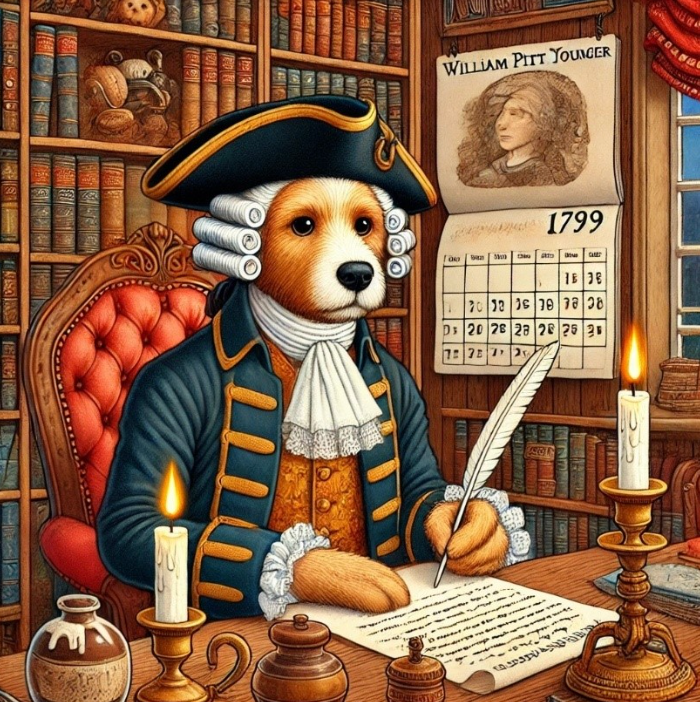

At the dying end of the 18th century, a little man with a big ego was throwing his weight around in Europe. His name was Napoleon. You might have heard of him.

At the same time, William Pitt the Younger, at an impossibly young age of 24, was the UK’s prime minister. He wasn’t given a particularly easy ride as, at the same time, King George III was losing his marbles.

In 1799, young Pitt introduced for the first time an income tax in order to pay for his fight with the angry little Frenchman. It was at this same time that he also introduced a remittance basis of taxation for overseas civil servants who, in today’s terminology, might be referred to as non-doms. The idea was to provide them with relief from these new taxes in relation to their overseas property.

Little did young Pitt know that he was creating a political football and a fiscal tightrope for centuries to come. Something that would only be cast aside some 226 years later.

So, it was a surprise when Jeremy Hunt the Beiger announced in Spring Budget 2024 the abolition of the remittance basis of taxation and, more generally, the removal of domicile as a main determining factor for UK taxation.

It was perhaps less of a surprise when Chancellor Rachel Reeves, with a slightly less impressive CV (even the made up one) when compared to Pitt, flourished the pen to sign the non-dom demise.

So, has the UK’s big tax dog finally had its day?

A woof guide to domicile.

So what is domicile and, by negative extension, non-domicile?

Although, unusually, domicile has had an important impact on a person’s tax position in the UK it is not a pure tax construct. It is a concept of general law.

It is therefore important to note that the proposed abolition of the non-dom tax changes are merely changes to the tax consequences of such a status. It does not change the position from a general law perspective. For example, they will apply to things like the law of succession and will even continue to be relevant for some double tax treaties.

Dicey, in his tome Conflicts of Laws, provides the authoritative definition of domicile of origin:

'every person receives at birth a domicile of origin…A legitimate child born during the lifetime of his father has a domicile of origin in the country in which his father was domiciled at the time of his birth'

In sum, one inherits a domicile of origin (“DO”) at birth. To use archaic terminology, where one is ‘legitimate’, then you inherit your DO from your father. Where your mother and father are not married, then a DO is inherited from one’s mother.

A DO is rather sticky and tenacious. There must be strong evidence that a domicile of choice (“DC”) has been acquired elsewhere for it to be overtaken. Indeed, one does not completely shed a DO. Instead, think of the DO as the foundation of a building. It will remain as it is until someone takes the trouble to build something on top of it. A DC might be built on this foundation.

Again, Dicey provides us with the commentary:

‘every independent person can acquire a domicile of choice by the combination of residence and intention of permanent and indefinite residence, but not otherwise’

As such, in order to build a DC, it is necessary to have:

- intention to reside permanently / indefinitely in a place; and

- physical residence in that place.

Where this is the case, and can be backed up by evidence, the edifice will remain strong.

However, where an element is missing then the walls will come tumbling down and you will be left with the foundations. In other words, your domicile of origin.

But this is a double edged sword.

What if little ‘ol me tried to assert I was domiciled in Spain? I have a domicile of origin in the UK (or should that be the People’s Republic of Yorkshire?) In order to develop a domicile of choice in Spain I would need to both be resident in Spain, but also show, and evidence, my intention to reside there indefinitely.

Of course, if I came back, or even just hopped across the border to France, then I no longer reside there and would no longer have a DC in Spain. My DO in the UK would revert. And that simply wouldn’t Labra-doo.

In part 2 of our series, we look at the pre-6 April 2025 rules, covering income tax, CGT, IHT, and trust regulations.

Find out what’s changing, why it matters, and how it could impact your financial planning.

Introduction More wealthy UK residents are exploring life overseas ahead of the 2026/27 tax year. Higher UK taxes, political uncertainty and a desire for a different way of living are all pushing people to look at alternatives. Four destinations stand out for high-net-worth UK individuals as at late 2025: 1. United Arab Emirates (Dubai) 2. Portugal 3. Switzerland 4. Malta Each offers a different blend of tax advantages, residency options and lifestyle. United Arab Emirates (Dubai) - Dubai is now the default choice for many UK entrepreneurs and professionals. Tax For individuals, there is currently no personal income tax on salaries, bonuses or most investment income, and no local capital gains or inheritance tax regime for individuals. There is VAT and a developing corporate tax regime, but personal tax remains far lighter than in the UK. The UK–UAE double tax treaty helps reduce the risk of the same income being taxed twice and needs to be considered alongside UK residence rules. Residency Common routes for UK nationals include: Employer- or company-sponsored residence visas Remote-worker visas for those employed or self-employed abroad Long-term “golden” style visas linked to investment, property or professional status Retirement options for over-55s. (All require private health insurance and periodic renewal.) Lifestyle Dubai offers a high standard of living, excellent connectivity and a large, well-established British community. Housing and schooling are expensive and the lifestyle can encourage overspending, but for many the tax position and opportunity outweigh the costs. Best for: Maximising net income and building or scaling a business in a dynamic, international city. Portugal - Portugal appeals to those who want EU residency, a milder climate and a slower pace of life. Tax The old NHR regime has closed to new applicants and been replaced by a newer incentive framework (often referred to as IFICI) aimed at certain professionals and activities. The UK–Portugal tax treaty reduces double taxation, and Portugal does not operate a classic wealth tax, though property-related charges can apply. (It's signed and ratified but not yet fully in force as of early 2026, which may slightly affect immediate tax planning). Residency Post-Brexit, common routes for UK nationals include: D7 visa – for those with sufficient passive income (pensions, investments, rentals). D8 / Digital Nomad visa – for remote workers with qualifying income from abroad. Work and other residence visas tied to employment or specific skills. These can lead to long-term residence and, ultimately, citizenship if physical presence and integration tests are met. Lifestyle Cost of living is generally below the UK (though higher in central Lisbon and the Algarve), English is widely spoken in cities, and the public and private healthcare systems are well regarded. There are large British and wider international communities. Best for: Those wanting EU residence, good quality of life and a balance of tax and lifestyle advantages. Switzerland - Switzerland attracts UK families who prioritise security, discretion and top-tier services. Tax Tax is set at federal, cantonal and communal level, so overall rates vary widely by canton. Well-chosen cantons can be very competitive for both individuals and companies. Private capital gains are not generally taxed, but there is an annual wealth tax on net assets, with rules depending on location. For suitable non-working individuals, some cantons still offer lump-sum (forfait) taxation, where tax is based on living costs rather than worldwide income, subject to minimum levels and conditions. Residency As non-EU nationals, UK citizens use: B permits – time-limited residence, often linked to work L permits – short-term residence for specific assignments C permits – longer-term settlement after sustained residence and integration Wealthy retirees and non-working individuals may be able to obtain residence based on financial self-sufficiency and, in some cantons, lump-sum taxation. Lifestyle High costs are offset by excellent infrastructure, schools and healthcare (with compulsory private health insurance). International communities are strong in Zurich, Geneva and other cities, though social life can feel more formal than Southern Europe. Best for: Those seeking stability, discretion and first-class public services and education, rather than the lowest day-to-day costs. Malta - Malta is a compact EU state with a very familiar feel for UK nationals: English is an official language and the legal and business environment is comfortable for British professionals. Tax Malta’s tax system and UK–Malta treaty can be particularly attractive where you hold significant foreign-source income. Under the Global Residence Programme, qualifying individuals can pay a favourable flat rate on foreign income remitted to Malta, while foreign capital gains kept offshore are generally not taxed in Malta. There is no separate wealth tax and no classic inheritance tax, though duties may apply to certain Maltese assets. The separate “golden passport” (citizenship by investment) route has been struck down by the EU’s top court, but residence programmes remain available. Residency Options for UK citizens include: Employer-sponsored Single Permits combining work and residence The Global Residence Programme for financially self-sufficient individuals meeting property and minimum tax thresholds Digital-nomad-style visas for remote workers Long-term residence after several years of compliant stay Lifestyle Costs (especially rent and property) are typically lower than in the UK outside the most fashionable areas. English is widely used in government and business, healthcare is solid, and London is only a short flight away. Best for: Those wanting an English-speaking EU base with favourable treatment of foreign-source income and a tight-knit expat community. How to decide & next steps - All four countries can work extremely well for UK high-net-worth individuals, but for different profiles: Choose Dubai if your priority is low personal tax on active income and you are comfortable with a high-energy city. Choose Portugal if EU residency, climate and lifestyle matter as much as tax. Choose Switzerland if stability, education and healthcare are at the top of your list. Choose Malta if you want an English-speaking EU base with flexible options for foreign income. The right answer depends on your overall wealth, income mix, family plans and how tied you remain to the UK. If you would like bespoke, confidential advice on whether remaining UK-resident or relocating to Dubai, Portugal, Switzerland or Malta is the better strategy for your situation, you are welcome to get in touch to explore your options in detail.